2022 Scorpio New Moon Eclipse – Hyperinflation Run Possible!

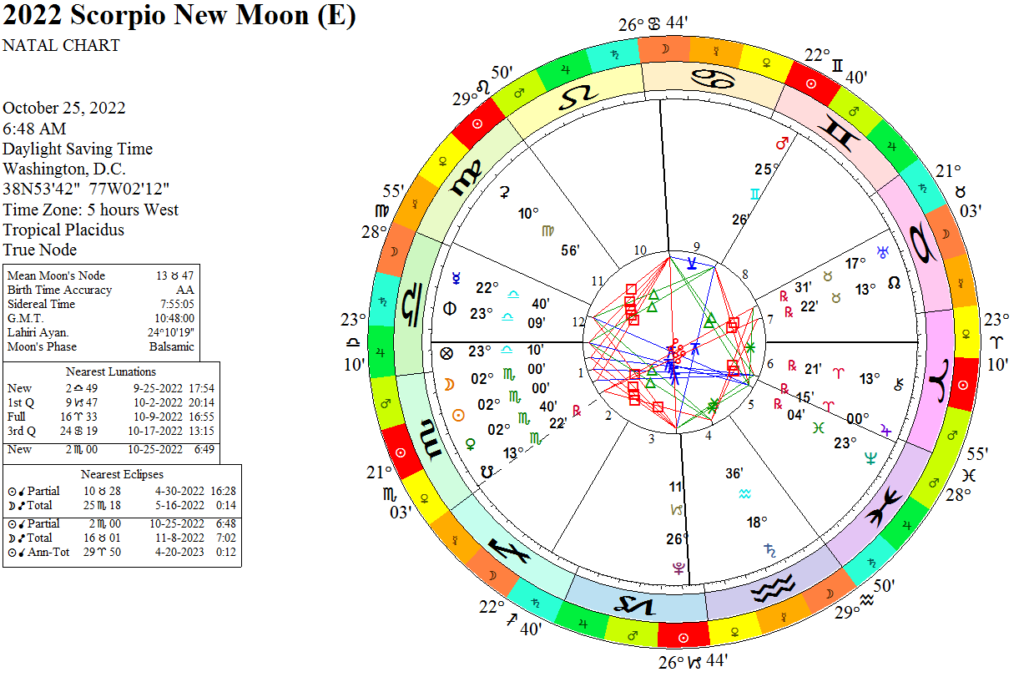

On October 25, 2022 at 6:48 AM, EDT, the last solar eclipse of 2022 occurs in Scorpio. For the US National chart over Washington, D.C., this places the eclipse in the 1st House. This Eclipse only has one aspect in the chart, Venus is also conjunct it. Therefore, this eclipse is primarily about the US it self. Specifically how it’s people are reacting with their money.

Currently, inflation is a multi decade high in the US. Gasoline inventories are plunges risking a shortage, while the rising interest rates has pushed the housing market to the brink of another depression. The economy is starting to slow down and there is a real risk of depression next year. Things are not looking good for the average American.

o how do the American people respond to this situation? They begin to get very emotional on where they save or spend their money. The eclipse suggest that it is very likely the old rules for monetary safe-havens no longer apply too. The Federal Reverse Bank is still forced to raise interest rates to combat inflation, however, this is putting enormous strain on the US Banking system. But the Federal Reserve Bank is planning to defend the value of the dollar at all cost.

This means traditional investment ins banking and bonds may not be the safe bets they usually are in recessions. With housing and the stock market appearing to be not good, where will the American people put their money?

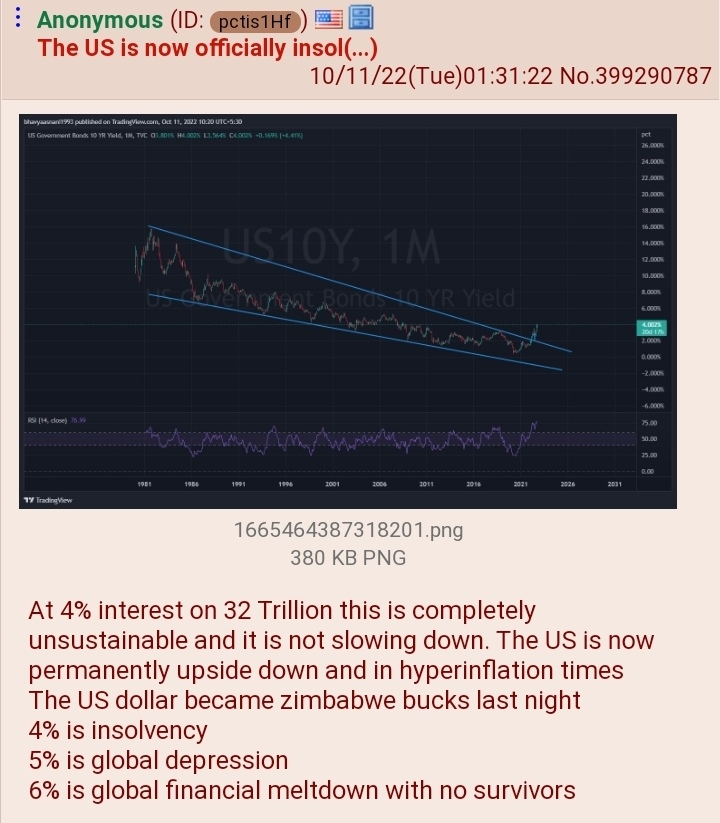

The answer is they will spend it on goods and services they need to survive or they think they will need in the next few years. Inflation is no where near under control as the federal reserve bank has not raised the rates high enough to combat it. The last time inflation in the US was this high, the Federal Reserve Bank raised rates to nearly 20%! With today’s economy which has functioned on historically low interest for the better part of two decades, such a raise would completely crash it.

With No Survivors.

So the Federal Reserve Bank is caught in a damned if you do and damned if you don’t situation. Either way they lose, and since no economist thinks the rates will go much above 5% inflation is here to stay.

And with the actions of the American people spending their money as soon as they can get it, hyperinflation is just around the corner.